Filing your Income Tax Return (ITR) is a legal responsibility and a vital part of personal and business finance. But even in 2025, many taxpayers continue to make costly ITR filing mistakes that lead to penalties, delayed refunds, or legal notices from the Income Tax Department.

Let’s explore the top 7 ITR filing mistakes most people still make—and how you can avoid them.

Not Reporting All Income Sources

One of the most common ITR filing mistakes is omitting income from secondary sources such as:

- Interest from savings and fixed deposits

- Freelance or consulting income

- Capital gains from crypto, stocks, or real estate

- Dividend income

Failing to report this data is one of the biggest ITR filing mistakes. The government now uses Form 26AS and AIS (Annual Information Statement) to monitor your income sources. If something doesn’t match, it could trigger a tax notice.

👉 Learn more about Form 26AS

Missing the Filing Deadline

Failing to file your ITR before the due date (typically July 31) is another expensive mistake. Late filing attracts a penalty under Section 234F, and you may lose eligibility to carry forward losses or claim certain deductions.

The deadline for individuals is typically July 31. Mark your calendar and avoid this common ITR filing mistake.

Choosing the Wrong ITR Form

Using the incorrect ITR form can lead to rejection or misreporting of income. For example:

- Salaried individuals should use ITR-1 or ITR-2

- Business owners and freelancers must use ITR-3 or ITR-4

Choosing the wrong form leads to delays and resubmissions. Always verify which form suits your income profile.

Not Matching 26AS/AIS with Declared Income

Another major ITR filing mistake is failing to match your declared income with data in Form 26AS and AIS. These statements include:

- TDS/TCS details

- Interest earned

- Mutual fund transactions

- Foreign remittances

A mismatch between this data and your ITR can lead to automated red flags. This is a key ITR filing mistake that’s easily avoidable by double-checking these forms.

Not Claiming Eligible Deductions and Exemptions

Many taxpayers pay more tax than necessary by not claiming deductions under:

- Section 80C (investments, PPF, ELSS)

- Section 80D (health insurance premiums)

- Section 24(b) (home loan interest)

- HRA exemptions

Failing to claim deductions is one of the easiest ITR filing mistakes to fix. Use documentation and calculate benefits before submitting your return.

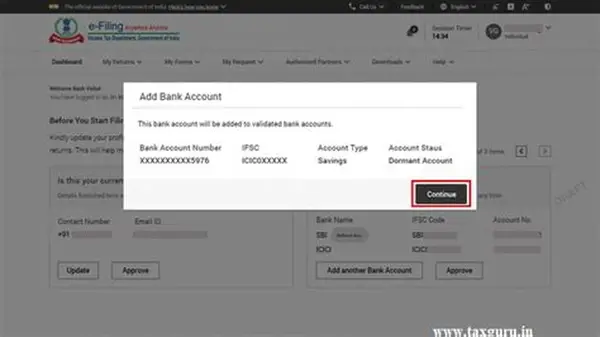

Errors in Bank Details or PAN

You might file everything correctly, but if your bank account number or IFSC code is wrong, your refund will not be credited. Similarly, a PAN-Aadhaar mismatch can also delay processing.

Before submitting, verify all personal details, including:

Bank account details

Name:

PAN:

Aadhaar:

Always double-check your personal and financial details before submission.

Relying Entirely on Automated Tools Without Review

While many use online portals or automated tools for e-filing, blindly relying on automation without reviewing entries is risky.

- The tool may miscategorize income

- Deductions may not auto-apply correctly

- Bank interest or capital gains may go unreported

Manually verify each section. If unsure, consult a tax professional. This simple step helps you avoid serious ITR filing mistakes.

For Businesses: Bonus Mistake – Ignoring Tax Audit Requirements

Businesses with turnover exceeding ₹1 crore (or ₹10 crore in certain digital transaction cases) must conduct a tax audit under Section 44AB. Failing to do so can result in hefty penalties.

Unlock Digi Services offers tailored assistance to ensure you comply with tax audit requirements and avoid costly oversights.

Final Thoughts: Avoid ITR Filing Mistakes with Expert Help

Filing your Income Tax Return is more than a compliance ritual—it’s about optimizing your finances, avoiding penalties, and staying stress-free. The 7 ITR filing mistakes listed above are common but entirely avoidable with the right knowledge and guidance.

- File accurately

- Avoid penalties

- Maximize your tax savings

- Get your refunds faster

Whether you’re a salaried professional, freelancer, or business owner, avoid these ITR mistakes in 2025 to ensure smooth processing and better financial health.

Ready to file your ITR with 100% accuracy?

Contact Unlock Digi Services today for error-free ITR filing, expert review, and personalized tax planning.

Let our tax professionals handle the complexities while you stay focused on your goals.