Confused about the documents required before filing ITR? This complete checklist helps you gather all essential paperwork—PAN, Form 16, salary slips, AIS, and more—so you can file your income tax return accurately and stress-free.

Why Do You Need These Documents Before Filing ITR?

Having the correct documents ensures your income details, tax deductions, and exemptions are accurately reported. You also reduce the risk of receiving notices from the Income Tax Department for discrepancies or missed reporting. Let’s look at what you need.

Important Documents Required for Filing ITR?

1. PAN Card

The Permanent Account Number (PAN) is your primary identity when it comes to filing taxes. It’s a unique 10-digit alphanumeric code issued by the Income Tax Department and is mandatory for filing ITR. Your PAN must be linked to your bank account for TDS (Tax Deducted at Source) purposes.

As per recent government guidelines, you can now also file ITR using your Aadhaar card, but PAN remains essential.

2. Aadhaar Card

According to Section 139AA of the Income Tax Act, linking your Aadhaar with PAN is mandatory. Your Aadhaar card serves as biometric identity proof and helps in OTP-based e-verification of your return. If misplaced, you can easily download a copy online from the UIDAI portal.

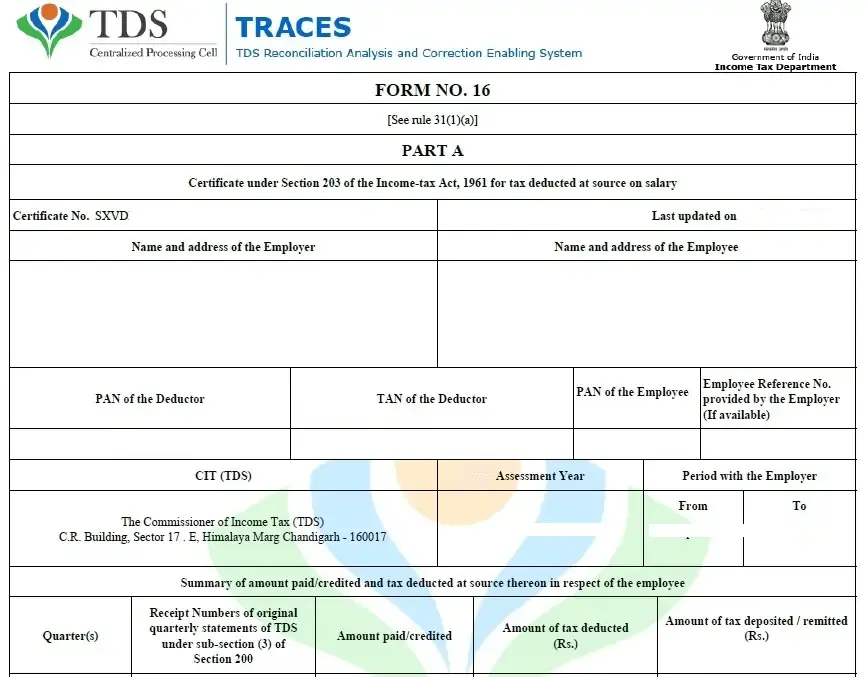

3. Form 16

For salaried individuals, Form 16 is one of the most important documents required before filing ITR. Issued by your employer, it contains details of your salary, tax deductions, and TDS deposited on your behalf.

Form 16 consists of:

- Part A: TDS details

- Part B: Salary breakup, deductions, and exemptions

Always ensure that Form 16 has the TRACES logo and unique ID to validate authenticity.

4. Monthly Salary Slips

While Form 16 gives an annual summary, your monthly salary slips offer a detailed view of salary components, allowances, and deductions. These are especially useful if you’re reconciling amounts or claiming exemptions not fully reflected in Form 16.

5. Form 26AS

Form 26AS is like a tax passbook. It records all tax deductions made against your PAN during the financial year—whether from salary, FD interest, or other income sources.

It also shows high-value transactions like foreign travel or large purchases. Always match your income and TDS with Form 26AS before filing to avoid any mismatch or missed credit.

6. Interest Certificates

Interest earned from savings accounts, fixed deposits, or recurring deposits is taxable. You must report this income correctly.

Get interest certificates from:

- Banks

- Post offices

- Other financial institutions

This also helps you claim deductions like Section 80TTA (for savings interest up to ₹10,000).

7. Investment Proofs

To claim deductions under Chapter VI-A (Sections 80C to 80U), you’ll need valid investment proofs. These include:

- ELSS mutual funds

- Life insurance premiums

- PPF, NSC, 5-year FD

- Home loan repayment

- Children’s tuition fee receipts

- Health insurance (Section 80D)

- Rent receipts or rental agreements (for HRA claims)

Keep receipts or digital proof handy in case you’re asked to verify.

8. Capital Gains Statements

If you’ve sold shares, mutual funds, or property, you’ll need to report capital gains or losses.

Collect:

- Property sale deed

- Broker or demat account statements

- Details of purchase and sale price

- Holding period for calculating long-term or short-term gains

Many taxpayers miss this step, but it’s essential for accurate reporting.

9. Bank Account Details

You must mention all active bank accounts in your ITR. Include:

- Bank name

- Account number

- IFSC code

- Account type

This is important for ITR validation, refunds, and income verification. You can choose one account for receiving the tax refund.

10. Annual Information Statement (AIS)

The AIS is a comprehensive record of your financial activity during the year. It includes:

- Salary credited

- Interest earned

- Dividend income

- Capital gains

- High-value transactions

Download it from the Income Tax e-filing portal to cross-check with your own records. It ensures that no income is left unreported.

Bonus Tip: Start Early to Avoid Last-Minute Panic

Don’t wait until the deadline. If you start early, you’ll have time to:

- Collect all documents required before filing ITR

- Rectify any missing or incorrect details

- E-file your return with ease

Related news

Final Thoughts

Having all the documents required before filing ITR makes your tax filing smoother and error-free. From PAN and Aadhaar to interest statements and Form 16, each document plays a key role. Save yourself from last-minute stress by staying organized. By organizing your essential documents before filing ITR, you can file accurately, avoid delays, and receive faster refunds.

Have questions? Drop them in the comments or message us directly. Let’s make tax filing easy and worry-free!

Still Confused? Let the Experts Handle It!

At Unlock Digi Services, we help individuals and small businesses file their ITRs accurately, confidently, and on time.

Expert Tax Support

Document Review Assistance

Fast & Hassle-Free Filing

Call/WhatsApp Us: +91 94819 60948

Email: info@unlockdiscounts.com

Let’s take the stress out of tax season—together!

FAQ: Common Questions About Essential Documents Before Filing ITR

Q1: I don’t have Form 16. Can I still file my ITR?

Yes, you definitely can. While Form 16 is one of the most helpful documents required before filing ITR, it’s not the only option. You can use your monthly salary slips and bank account statements to calculate your income manually.

Q2: What if I’ve lost one of the required documents?

It happens — don’t worry. Just get in touch with the issuer, whether it’s your employer, bank, or investment platform. Most of the documents required before filing ITR can be reissued or downloaded again digitally.

Q3: Is Aadhaar really compulsory for filing ITR?

Yes, it is. Among the important documents required before filing ITR, your Aadhaar card and its link to your PAN is a must-have. If they’re not linked yet, you should complete that process before filing.