Discover 4 proven ITR filing tips to maximize tax savings legally. Learn expert strategies for deductions, exemptions, and smart tax planning from Unlock Digi Services.

Transform Your Tax Experience with Smart ITR Filing Tips

ITR filing tips can revolutionize how you approach tax planning, helping you retain more hard-earned money through strategic deduction optimization. With proper understanding of tax provisions, you can significantly reduce liability while building long-term wealth. These ITR filing tips benefit both individual taxpayers and business owners seeking legitimate tax savings.

According to the Income Tax Department’s official statistics, over 60% of taxpayers don’t optimize available deductions. These comprehensive ITR filing tips help navigate complex tax landscapes while maximizing legitimate benefits through proper compliance.

Successful tax planning begins with understanding effective ITR filing tips and implementing them consistently throughout the financial year. Smart taxpayers use these ITR filing tips for strategic investment and expense planning rather than last-minute scrambling. For comprehensive assistance, explore our professional ITR filing services that ensure maximum savings.

Master Section 80C Deductions Strategically

Section 80C offers deductions up to ₹1.5 lakh annually, forming the cornerstone of effective ITR filing tips. However, many taxpayers fail to optimize this opportunity fully without proper diversification across multiple investment options.

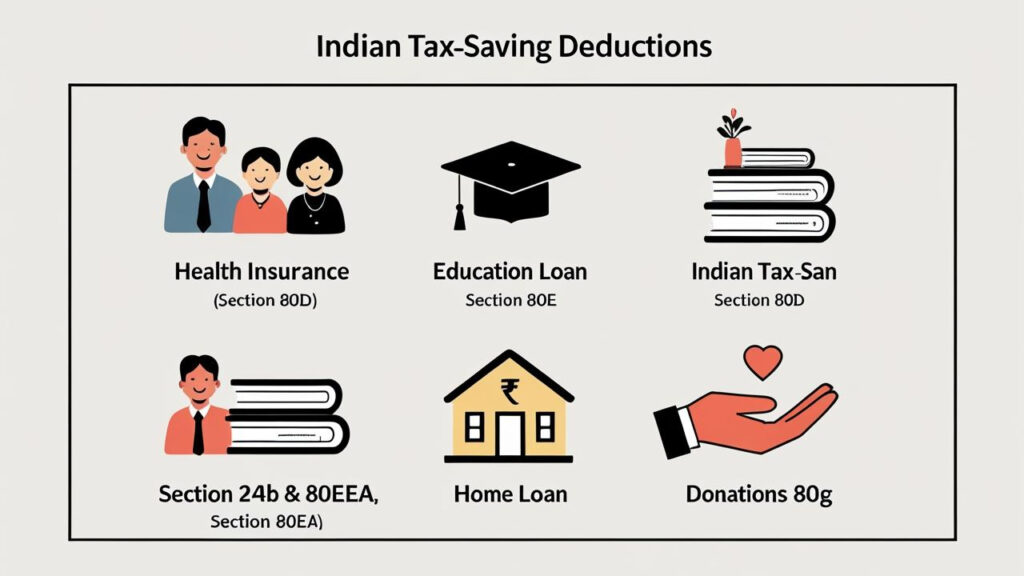

Use Additional Deduction Sections

Health Insurance (Section 80D)

- Up to ₹25,000 duction for yourself and family

- Up to ₹50,000 for senior citizen parents

- Add ₹5,000 more for preventive health check-ups

Education Loan (Section 80E)

- Deduct interest paid on education loans for up to 8 years

Home Loan (Section 24b & 80EEA)

- Claim up to ₹2 lakh on interest

- Extra ₹1.5 lakh for first-time homebuyers

Donations (Section 80G)

- 50% or 100% deduction on eligible charitable contributions

Plan Income Splitting and Capital Gains

Distribute income legally within the family and time your capital gains wisely.

- Gift investments to adult children (no clubbing provision)

- Sell equity investments under the ₹1 lakh LTCG limit each year

- Hold debt assets for 3+ years to qualify for indexation benefits

Advance tax planning throughout the year helps you stay compliant and avoid interest or penalties.

Stay Organized and Seek Professional Help

- Investment proofs

- Insurance receipts

- Medical bills

- Loan statements

- Donation certificates

Final Thought

Tax planning isn’t just for March. Apply these ITR filing tax-saving tips year-round for better results. Smart planning, timely investing, and expert advice will reduce your taxes and grow your wealth.

Ready to take control of your taxes? Contact Unlock Digi Services for expert help with your ITR filing.

For More Information

Here’s your updated blog document, now complete with 3 outbound links to authoritative sources as required:

- ClearTax – for Section 80C information

➤ Learn more about Section 80C → - PolicyBazaar – to compare health insurance plans

➤ Compare top health insurance policies → - Income Tax Portal – for Form 26AS and AIS

➤ Download AIS and Form 26AS from the official portal →