The Goods and Services Tax (GST) was introduced in India as a revolutionary step to simplify indirect taxation, promote transparency, and boost business efficiency. While it undoubtedly brought a streamlined tax structure, there’s a lesser-known side—The Dark Side of GST—that entrepreneurs often overlook, especially those entering competitive markets without prior tax expertise.

For new and growing businesses, these pitfalls in the Dark Side of GST can cause unexpected cash flow issues, penalties, delayed growth opportunities, and compliance nightmares. Understanding these hidden traps is essential for safeguarding your profits, protecting your business reputation, and keeping your operations firmly on the right side of the law.

1. Complex Compliance Burden Despite ‘One Nation, One Tax’

On paper, GST was meant to simplify tax filing, but in reality, the compliance process can be overwhelming—especially for small and medium enterprises (SMEs) struggling with limited resources. Monthly filings, multiple returns, reconciliation with vendors’ filings, and strict deadlines create a web of responsibilities and constant administrative pressure. Missing just one due date can lead to hefty late fees and interest charges, causing unnecessary financial strain.

According to GSTN official updates, late fees can be up to ₹50 per day for each return. For a small business, these costs add up quickly, making the Dark Side of GST compliance a serious and ongoing financial threat.

2. Cash Flow Blockages Due to Input Tax Credit (ITC) Delays

One of the biggest selling points of GST was the Input Tax Credit mechanism, allowing businesses to claim tax already paid on purchases. However, if your supplier fails to upload invoices or make GST payments on time, your ITC claim can be blocked—leaving you to bear double taxation until the issue is resolved, which is a prime example of the Dark Side of GST.

Entrepreneurs in sectors like retail, manufacturing, and wholesale trade often face months-long delays, severely choking cash flow and directly impacting day-to-day operations and business growth potential.

3. Risk of Heavy Penalties and Legal Action

The Dark Side of GST also includes the severity of penalties for even minor mistakes that entrepreneurs often underestimate. Wrong classification of goods, underreporting turnover, or unintentional errors can lead to 100% of the tax amount as a penalty, plus additional interest charges in certain cases. In extreme situations, the GST department can initiate surprise audits, inspections, or even raids, disrupting business operations.

For example, a small e-commerce seller misclassifying goods can face penalties in lakhs, far exceeding their profit margins and causing long-term financial damage. CBIC guidelines detail how these penalties are enforced, and the risks are far higher than most new entrepreneurs realize when dealing with the Dark Side of GST.

4. GST Fraud Risks—Even Without Your Knowledge

Fraudulent GST activities, such as fake invoicing, are a growing problem. The dangerous part? Even if you unknowingly deal with a fraudulent supplier, your business can still face ITC reversals, financial losses, and serious legal action.

This is why due diligence is crucial—verifying your suppliers’ GST compliance before engaging in business transactions is essential to avoid falling victim to the Dark Side of GST and being caught in the crossfire.

5. Industry-Specific Disadvantages

While GST benefited many industries, some sectors face unique disadvantages. For example, service providers often face double taxation when dealing with clients in states where they are not registered. Similarly, SMEs in the textile and handicraft industries often deal with additional compliance costs that eat into already slim margins.

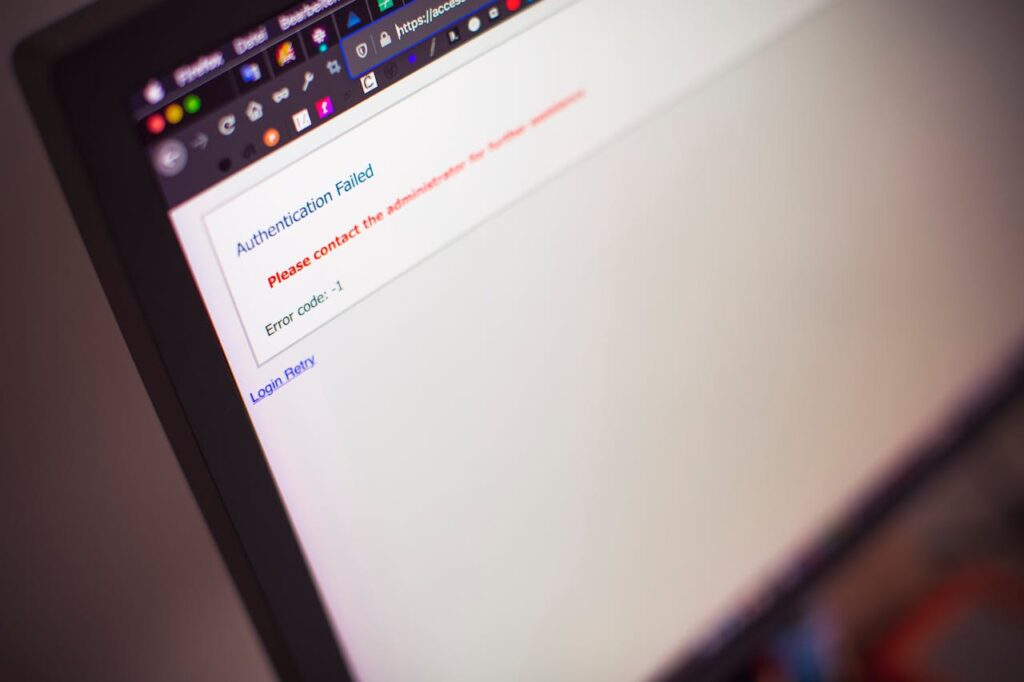

6. Digital Dependency and Technical Glitches

The GST system relies heavily on the GSTN portal. Any technical glitch—whether during high-traffic filing days or due to maintenance—can disrupt your ability to file returns on time. Unfortunately, the penalties for late filing still apply, regardless of whether the delay was due to system errors.

7. Impact on Working Capital for Small Businesses

For businesses with thin profit margins, GST’s structure can lock away funds for months. Advance tax payments, delays in refunds, and blocked ITC create significant strain on working capital. This often forces small entrepreneurs to take short-term loans, increasing financial stress.

The Takeaway: Navigating the Dark Side of GST

While GST has simplified India’s tax landscape, the Dark Side of GST is real and potentially damaging—especially for entrepreneurs unaware of its hidden traps. The key to avoiding these pitfalls lies in proactive compliance, regular reconciliation, supplier verification, and staying updated with GST law changes.

Hiring a professional GST consultant or using automation tools can also help minimize risks. At Unlock Digi Services, we specialize in helping entrepreneurs navigate complex digital and compliance challenges, so you can focus on growing your business instead of battling tax headaches.

Don’t let GST pitfalls slow your growth. Contact Unlock Digi Services today to get expert guidance on GST compliance, automation, and business optimization.