Starting a new business is exciting, but GST compliance is not optional. For any startup in India, understanding the Goods and Services Tax (GST) framework is crucial to building a strong financial foundation. GST compliance tips for startups aren’t just regulatory checkboxes—they are essential steps to avoid penalties, ensure smooth operations, and build long-term credibility in the market.

Whether you’re launching a tech-based startup, setting up an e-commerce store, or offering digital services, staying compliant with GST norms from day one can save you from costly errors and missed opportunities. Failing to comply with GST regulations can lead to fines, delays in business processes, and even suspension of operations.

At Unlock Digi Services, we specialize in helping new and growing businesses understand and implement GST compliance tips for startups effectively. If you’re looking for expert assistance, check out our professional GST filing services to ensure your returns are always filed correctly and on time. Our goal is to make tax compliance easy, stress-free, and accessible—even for first-time entrepreneurs.

To help you get started on the right path, here are 8 powerful GST compliance tips for startups that will keep your business tax-ready, future-proof, and legally protected.

1. Register for GST Early

The first step toward compliance is getting your GSTIN (GST Identification Number). Any business with an annual turnover exceeding ₹40 lakhs (₹20 lakhs for services in most states) must register for GST.

Early registration avoids delays in billing, enables tax credit claims, and boosts customer trust. Even if you’re not legally required to register, doing so can give you a competitive advantage.

👉 Learn more about GST registration on the official GST portal

2. Understand Your GST Category

Startups may fall under different GST schemes:

- Regular Scheme – For businesses exceeding turnover thresholds.

- Composition Scheme – For small businesses with turnover under ₹1.5 crore (lower compliance, no ITC).

Evaluate what category suits your model best. Each scheme has different rules for returns, invoicing, and tax rates.

3. Keep Invoices GST-Compliant

Invoices must follow the prescribed format under GST laws. They should include:

- GSTIN of supplier and recipient

- Invoice number and date

- HSN/SAC code

- Taxable value, tax rate, and tax amount

Proper invoices are crucial for claiming Input Tax Credit (ITC) and passing tax benefits to customers. A mistake here can invalidate your ITC claims.

4. Maintain Digital Records of All Transactions

As per GST law, every registered business must retain records for 6 years. This includes sales invoices, purchase bills, credit/debit notes, payment receipts, and GST return filings.

Use accounting software or cloud tools to automate record-keeping and reduce human error. This helps ensure quick compliance during GST audits or notices.

5. Timely Return Filing is Key to GST Compliance

Late filing attracts penalties and interest charges. Common returns include:

- GSTR-1 (outward supplies)

- GSTR-3B (monthly summary)

- GSTR-9 (annual return)

Even NIL returns must be filed! Schedule reminders or use professional services like Unlock Digi Services to avoid last-minute rushes and mistakes.

👉 Check latest GST return dates on ClearTax

You can also refer to the official guide to GST return filing provided by the Central Board of Indirect Taxes and Customs (CBIC) for accurate and updated instructions.

6. Claim Input Tax Credit (ITC) Correctly

Startups can save a lot by claiming ITC on purchases made for business. But the supplier must file GSTR-1 correctly, and your purchase invoice must match GSTR-2B data.

Key ITC rules to follow:

- Keep tax invoices ready

- Ensure timely supplier filings

- Avoid ITC on exempt or non-business expenses

This step is vital for cash flow management in a new business.

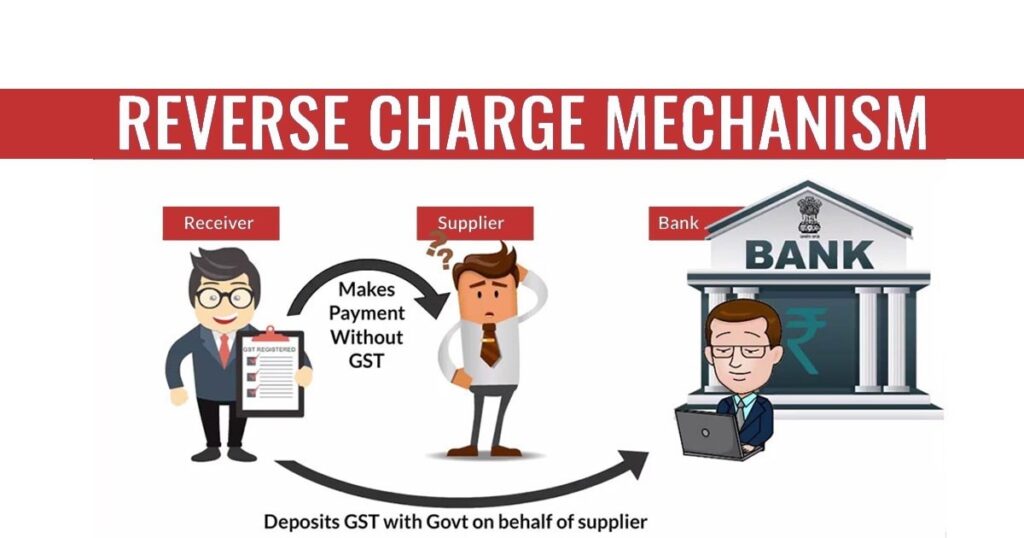

7. Track Reverse Charge Mechanism (RCM)

If you receive goods/services from unregistered vendors or import services, you’re liable to pay GST under RCM. This applies to specific industries and services such as legal, transportation, or security services.

Startups often overlook this and end up paying penalties later. Consult a tax expert if you’re unsure whether RCM applies to your business.

8. Stay Updated with GST Notifications

GST laws are dynamic. Amendments, rate changes, or filing relaxations are frequent. Subscribe to reliable newsletters or consult professionals to stay current.

For instance, recent changes include auto-populated GSTR-2B, e-invoicing for businesses over ₹5 crore turnover, and strict late fee rules.

At Unlock Digi Services, we offer real-time GST compliance monitoring so you never miss an update.

Final Thoughts: Don’t Let GST Mistakes Cost You

The early stages of a startup are sensitive. Non-compliance with GST can lead to financial setbacks, loss of credibility, and even legal issues. Following the above GST compliance tips for startups not only ensures smooth operations but also builds investor and customer trust.

✅ Let Unlock Digi Services handle your GST compliance while you focus on growing your business.

Need help with GST filings, ITC claims, or registration?

Contact Unlock Digi Services today and let our experts simplify your GST compliance and tax journey.

👉 Get your FREE GST consultation now at email: info@unlockdiscounts.com or call us at +91 94819 60948

Let’s grow your startup—compliantly and confidently.

One Response