Discover how your GST certificate can unlock loans, build trust, and scale your business. Learn the benefits and steps in our simple guide.

Why Your GST Certificate Matters

Most people think a GST certificate is just a formality — something you get to pay taxes. But here’s the truth: Your GST Certificate Is More Powerful Than You Think. It’s not just a tax document — it’s a growth tool for businesses, freelancers, startups, and service providers.

Whether you’re running an e-commerce store, managing a small business, or starting as a freelancer — having a valid GST certificate can unlock doors to bigger opportunities, faster payments, and stronger credibility.

What is a GST Certificate?

A GST certificate is an official document issued by the Government of India to individuals and businesses after successful GST registration. It contains your GSTIN (Goods and Services Tax Identification Number) and is mandatory if your turnover exceeds ₹20 lakhs (₹10 lakhs for NE states and UTs).

You can download your GST certificate from the official portal:

https://www.gst.gov.in

Why the GST Certificate Is More Powerful Than You Think

Let’s break down the hidden benefits:

1. Builds Business Credibility

Customers, suppliers, and partners prefer businesses that are GST registered. It shows you’re compliant, organized, and trustworthy.

Bonus: You can display your GSTIN on your website, invoices, and packaging to strengthen trust.

2. Enables B2B Deals and Bulk Orders

Without a GST certificate, large businesses or vendors may refuse to work with you. B2B transactions almost always require GST bills for claiming input tax credits. This document helps you qualify for bigger contracts.

3. Boosts Loan & Funding Eligibility

Banks, NBFCs, and lenders often request your GST return filings and certificate before approving loans. With regular filings, it acts as proof of stable income — helping you access working capital or business expansion loans.

4. Helps in eCommerce & Marketplace Selling

Planning to sell on Amazon, Flipkart, or Meesho? You’ll need a valid GST number. A GST certificate is mandatory to get started and list your products or services.

5. Allows You to Claim Input Tax Credit

One of the biggest benefits is that you can claim tax credit on the goods and services you purchase. This significantly reduces your overall tax liability and increases profitability.

6. Mandatory for Government Tenders or Contracts

Want to apply for a government project or public tender? A valid GST certificate is a basic eligibility criterion. This single document puts you on a professional playing field.

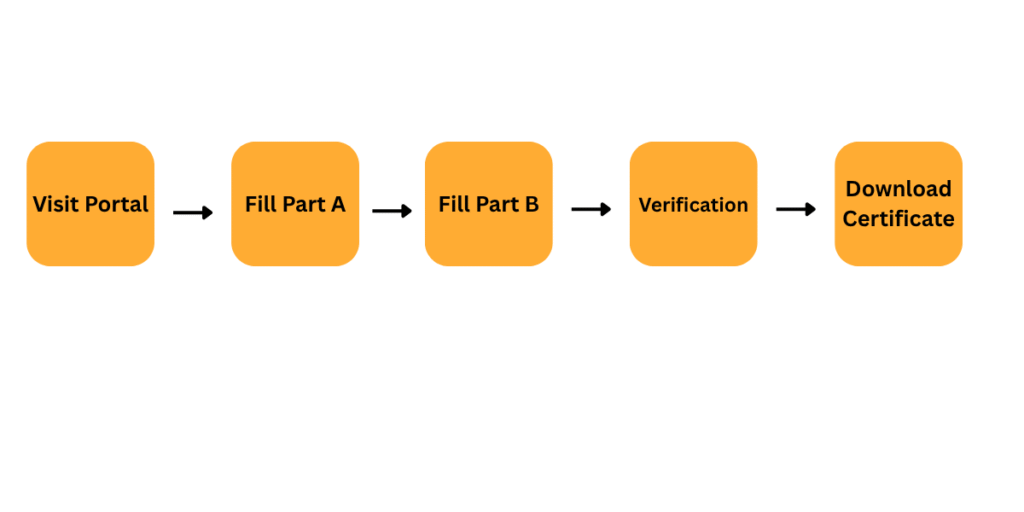

How to Get Your GST Certificate: Step-by-Step

Step 1: Visit the Official GST Portal

Go to https://www.gst.gov.in and click “Register Now”.

Step 2: Fill Part A (PAN, Email, Mobile)

Receive OTPs and verify your contact info.

Step 3: Fill Part B (Business Info & Upload Documents)

Upload PAN, address proof, Aadhaar, bank details, and business photos.

Step 4: Verification & ARN Generation

After document verification, you’ll get an ARN (Application Reference Number).

Step 5: GSTIN Allotment & Certificate Download

Post-approval, your GSTIN is issued and certificate can be downloaded.

Who Should Get a GST Certificate?

- Businesses with turnover above ₹20L (or ₹10L in some states)

- Freelancers and consultants who raise invoices

- E-commerce sellers or online service providers

- Anyone needing to claim Input Tax Credit (ITC)

- Startups planning to apply for loans or tenders

Final Thoughts: It’s Not Just a Document – It’s a Gateway

Your GST Certificate Is More Powerful Than You Think. It’s your ticket to building credibility, growing your income, and staying ahead of tax hassles. For many, it’s the start of financial discipline and long-term success.

How Unlock Digi Services Can Help

At Unlock Digi Services, we make GST filing and registration smooth, fast, and error-free. Whether you’re a startup or established business, our experts guide you every step of the way.

Still Confused About GST or Filing Process?

Book your free GST consultation with Unlock Digi Services and get professional advice tailored to your business.

“Stay compliant, stay confident – let us handle the GST while you grow your business.”

Call or WhatsApp: +91 94819 60948

Email: info@unlockdiscounts.com

Visit: Unlock Digi Services Website

Let our experts simplify the process for you — no stress, no confusion!