Avoid 5 deadly GST filing mistakes that trigger tax audits. Learn expert compliance strategies to prevent penalties and ensure smooth GST returns with professional guidance.

Why GST Filing Accuracy Is Critical for Business Survival

GST filing mistakes can transform routine compliance into a nightmare of audits, penalties, and legal complications. With over 1.3 crore registered taxpayers under the GST regime, tax authorities have become increasingly sophisticated in identifying discrepancies that trigger detailed scrutiny. Understanding common GST filing mistakes helps businesses maintain compliance while avoiding costly audit processes.

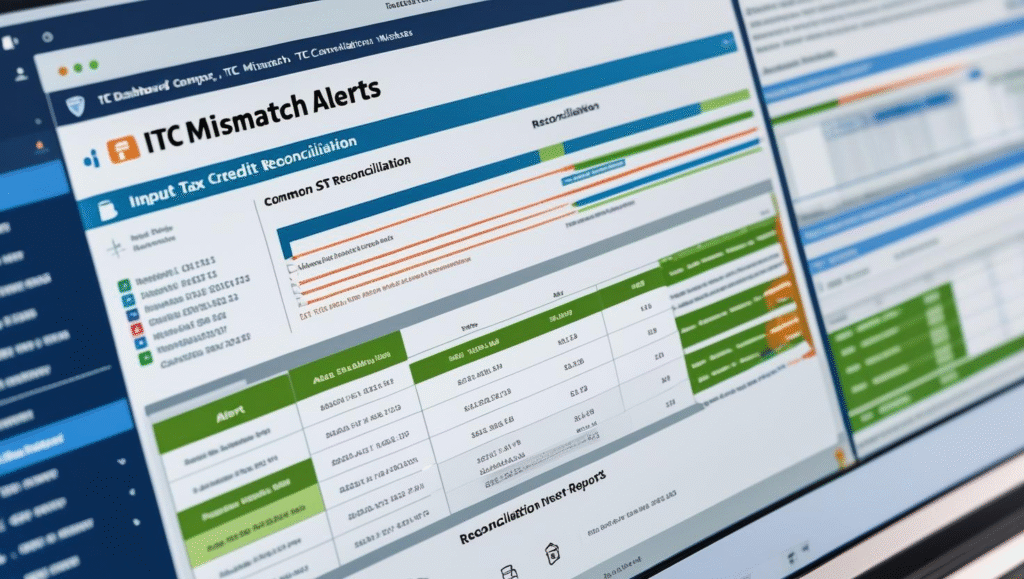

Input Tax Credit Reconciliation Disasters

Input Tax Credit (ITC) mismatches represent one of the most common GST filing mistakes that immediately flag returns for scrutiny. The GST system automatically cross-verifies ITC claims against supplier filings, making discrepancies highly visible to tax authorities.

Many businesses claim ITC based on purchase invoices without ensuring corresponding entries in GSTR-2A. This fundamental GST filing mistake occurs when suppliers delay their return filing or report incorrect details. The automated matching system identifies these discrepancies instantly, triggering investigation processes.

Reverse charge mechanism complications further compound ITC-related GST filing mistakes. Businesses often forget to pay tax under reverse charge while claiming corresponding ITC, creating imbalances that attract audit attention. According to Central Board of Indirect Taxes and Customs guidelines, proper reverse charge compliance prevents 80% of ITC-related queries.

HSN Code Classification Nightmares

HSN code errors represent another critical category of GST filing mistakes that trigger intensive scrutiny. Incorrect classifications can result in wrong tax rates, affecting both output tax liability and input tax credit eligibility.

Businesses often select HSN codes based on broad product descriptions without considering specific technical characteristics that determine correct classifications. This approach leads to GST filing mistakes that compound over time, creating significant compliance gaps that auditors easily identify.

Wrong HSN codes directly affect tax rate applications, creating cascading errors throughout GST returns. These GST filing mistakes can result in short payments, excess claims, or incorrect input credit calculations that immediately alert automated screening systems.

Late Filing Penalty Traps

Consistent late filing represents one of the most visible GST filing mistakes that guarantee increased scrutiny from tax authorities. The GST system tracks filing patterns, and repeated delays signal potential compliance issues that warrant investigation.

Late filing penalties extend beyond immediate financial costs to include heightened audit probability. Businesses with consistent late filing histories face automatic selection for detailed scrutiny, regardless of other compliance parameters. These GST filing mistakes create negative compliance profiles that persist across multiple assessment periods.

Interest charges on late payments compound rapidly, creating substantial financial burdens that affect business cash flow. More importantly, the payment delay pattern becomes part of the business’s compliance score, influencing future audit selection algorithms.

Invoice Documentation Failures

Invoice-related discrepancies constitute a major category of GST filing mistakes that immediately attract audit attention. The GST system requires specific mandatory fields, and missing or incorrect information triggers automated scrutiny processes.

GST invoices must contain precise details including correct party information, accurate GSTIN numbers, proper address details, and exact product descriptions. Even minor errors in these elements can trigger comprehensive audits, as they suggest broader compliance weaknesses.

Sequential invoice numbering requirements catch many businesses off-guard. Gaps in invoice sequences or duplicate numbers represent serious GST filing mistakes that auditors interpret as potential suppression of transactions or system control failures.

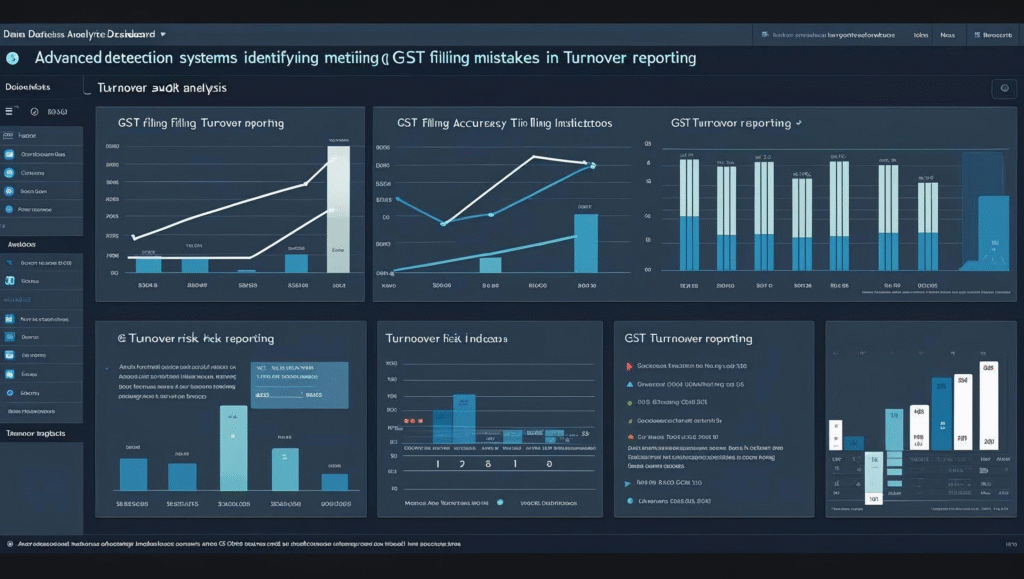

Turnover Suppression Red Flags

Turnover suppression represents the most serious category of GST filing mistakes, carrying severe penalties including prosecution possibilities. Tax authorities employ sophisticated data analytics to identify patterns suggesting deliberate suppression or evasion attempts.

The GST system now employs artificial intelligence to analyze business patterns, comparing reported turnover against industry benchmarks, electricity consumption, employee counts, and other economic indicators. Significant deviations trigger intensive audit processes.

Cross-verification with third-party data sources including bank statements, import-export records, and state VAT histories helps authorities identify potential suppression cases. These analytical capabilities make traditional evasion methods easily detectable.

Complete and accurate reporting remains the best defense against suppression allegations. Businesses should maintain detailed transaction records, ensure all sales appear in GST returns, and promptly report any discovered omissions through voluntary disclosure mechanisms

Transform Your GST Compliance Strategy

Avoiding these five critical GST filing mistakes requires systematic compliance management, regular training updates, and professional guidance for complex situations. The cost of prevention through proper systems and professional support far outweighs the consequences of audit processes, penalties, and business disruption.

These GST filing mistakes represent the most common triggers for tax department scrutiny, but they are entirely preventable with proper planning and execution. Professional compliance support becomes invaluable for businesses managing complex GST requirements, multiple registrations, or high-volume transactions.

Ready to eliminate GST filing mistakes and ensure bulletproof compliance? Contact Unlock Digi Services today for comprehensive GST filing support and expert compliance strategies that protect your business from audit risks.

For more information

1. GST Portal – Official Government Website

URL: https://www.gst.gov.in/ Link Text: “GST Portal’s official compliance guidelines” Relevance: This is the primary government portal for GST filing, making it the most authoritative source for compliance information and filing procedures.

2. Central Board of Indirect Taxes and Customs (CBIC)

URL: https://www.cbic.gov.in/ Link Text: “CBIC’s latest GST audit and penalty guidelines” Relevance: CBIC is the regulatory authority for GST in India, providing official notifications, circulars, and audit procedures that directly relate to the blog’s content about audit triggers.

3. Institute of Chartered Accountants of India (ICAI) – GST ResourcesURL:https://www.icai.org/