Does Your GST Number Match Your Business Activity? Here’s Why It Matters

If you’re running a business in India, having a Goods and Services Tax (GST) number is mandatory once your turnover crosses the threshold. But simply having a GST number isn’t enough—your GST Number and Business Activity Match must be accurate and aligned. If there’s a mismatch, it can lead to compliance issues, penalties, or even denial of input tax credit. Ensuring that your – GST registration truly represents what your business does is more important than many realize.

Many business owners unknowingly select the wrong HSN or SAC code while registering for GST. This simple mistake can lead to compliance issues, penalties, and even delays in refunds or GST returns.

A mismatch in your GST number and business activity can raise red flags during audits and put you at risk for penalties.

“What Is a GST Number and Why Is a GST Number and Business Activity Match Important?”

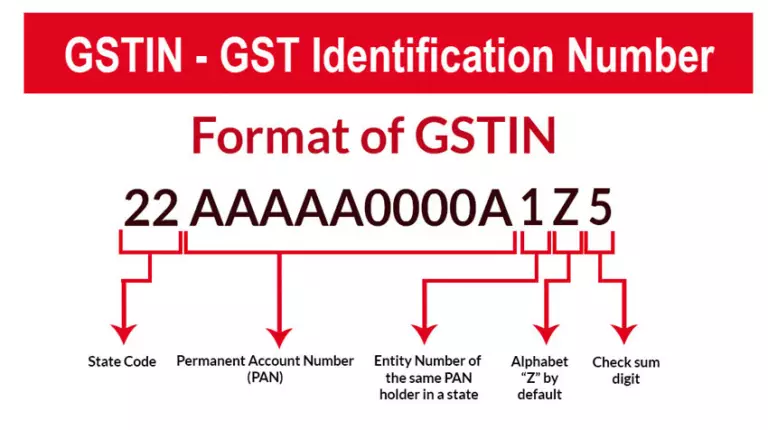

“According to the official GST portal, every business exceeding the turnover limit must register under GST and disclose their correct business activity.” A GST number (GSTIN) is a unique 15-digit identification number assigned to businesses registered under the GST system in India. Part of this registration process includes selecting the correct business activity type, along with the relevant HSN (Harmonized System of Nomenclature) or SAC (Services Accounting Code).

Your business activity code helps determine:

- The tax rate applicable to your goods or services

- The classification of your transactions

- Eligibility for Input Tax Credit (ITC)

- Whether your returns and invoices are valid

A mismatch in your GST Number and Business Activity Match can raise red flags during audits and put you at risk for penalties.

What Happens If Your GST Number Doesn’t Match Your Business Activity?

Incorrect GST classification can cause several issues:

Increased Risk of Audit

The GST department uses advanced analytics to flag discrepancies. A mismatch between your declared activity and actual invoices can trigger a GST audit.

Penalties and Fines

You may be fined under Section 122 of the CGST Act for wrongful classification or misinformation during GST registration.

Input Tax Credit (ITC) Rejections

Claiming ITC on goods or services not related to your registered activity can lead to rejection of credit, affecting your cash flow.

Refund Delays

Businesses dealing with exports or inverted duty structures rely on timely GST refunds. Any inconsistency in business classification can stall the process.

Common Scenarios Where GST and Business Activity Don’t Match

Freelancers and Consultants

Many service providers choose a generic SAC code like “9997 – Other Services” instead of selecting one that specifically describes their activity.

E-Commerce Sellers

Product sellers often skip accurate HSN codes, leading to errors in tax invoices and filings.

Startups

New businesses sometimes select “trading” instead of “software development”, or “consulting”, which creates issues when they scale or undergo scrutiny – “GST Number and Business Activity Match”

Multi-Vertical Businesses

Businesses offering multiple services may not update their GST profile with all relevant business activities – “GST Number and Business Activity Match”

How to Check If Your “GST Number and Business Activity Match”

You can verify your classification using the GST Portal:

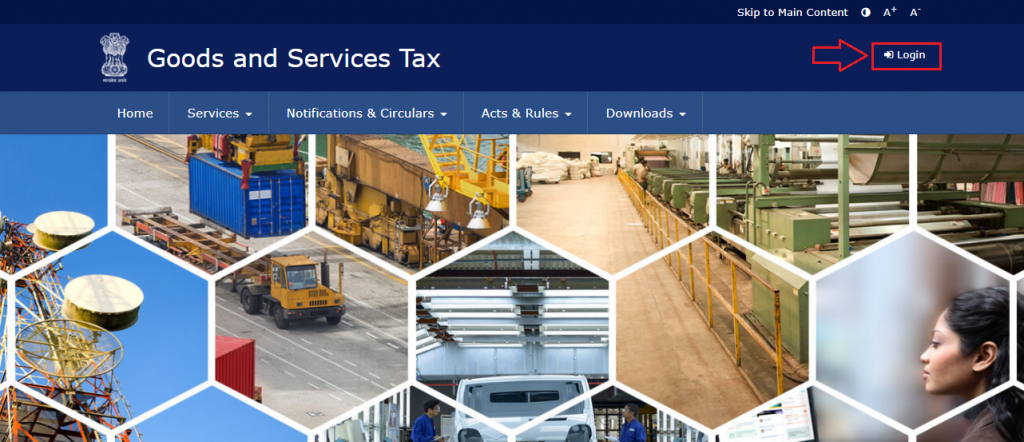

- Visit www.gst.gov.in

- Go to ‘Search Taxpayer’ and enter your GSTIN

- View the registered business activity

- Cross-check with your actual operations and invoicing

For services, check your SAC codes. For goods, ensure your HSN codes match the products you’re dealing in.

Why Accurate GST Classification Is Critical for Businesses

Better GST Compliance

Accurate classification ensures that your invoices, returns, and ITC claims are in line with your business model—leading to fewer errors.

Builds Credibility

Potential vendors, partners, and even clients can look up your GST information. Mismatched business activity can hurt your credibility.

Smoother Audits & Assessments

If your GST profile reflects your real operations, audits become a routine check, not a stress-inducing event – “GST Number and Business Activity Match”

How to Fix a Mismatched GST Number and Business Activity

If you’ve realized there’s a mismatch, don’t panic. You can rectify it via the Amendment of Core Fields on the GST portal – “GST Number and Business Activity Match”

Step-by-Step Guide:

- Log in to GST Portal

- Go to Services > Registration > Amendment of Core Fields

- Select Principal Place of Business

- Update your business activity and HSN/SAC codes

- Submit using DSC/EVC

Note: Once submitted, your request will go for approval by the GST officer.

GST Activity Classification Tips from Unlock Digi Services

Here’s how to avoid common mistakes while registering or amending your GST:

Use Accurate SAC or HSN Codes

Use government-issued lists to find the right classification:

Declare All Activities

If you run multiple services or products, include all relevant activities in your GST profile.

Update When You Expand

Scaling your business into new areas? Update your business activity immediately to reflect the change.

Seek Expert Help

Consult a GST expert or use Unlock Digi Services to avoid errors that could cost you in the long run.

How Unlock Digi Services Can Help

At Unlock Digi Services, we offer:

- * Free GST profile reviews

- * Business activity classification audits

- * Amendment filing and follow-up

- * GST registration for new businesses

- * nvoicing and compliance guidance

Our experts understand the nuances of GST regulations and will ensure your GST number and business activity are perfectly aligned – “GST Number and Business Activity Match”

Final Thoughts – Accuracy is the Key to GST Success

The GST system is getting smarter with time, and so should your business.

A mismatch between your GST number and business activity might seem minor, but it can cause significant financial and legal trouble.

Whether you’re a freelancer, startup founder, or SME owner—make sure your GST classification reflects your actual business model.

Let Unlock Digi Services ensure you stay compliant and confident – “GST Number and Business Activity Match”

“Still unsure about your GST Number and Business Activity Match? Let our experts help. Book your free consultation today!”

Don’t Wait for a Penalty Notice — Act Now! Let our experts at UnlockDigiServices review your GST registration and help you avoid mismatches, penalties, and audit risks.

Contact us today or visit UnlockDigiServices.com to schedule a FREE GST consultation.

Stay compliant. Stay confident. File the right way.