Filing your Income Tax Return (ITR) every year is not just a legal duty but also an opportunity to claim refunds and manage your finances better. However, ITR Mistakes That Can Drain Your Hard-Earned Money are surprisingly common among both individuals and businesses. A single error in reporting income, missing deadlines, or selecting the wrong form can lead to penalties, refund delays, or even notices from the Income Tax Department – Income Tax Mistakes.

This guide explains 7 critical ITR mistakes that every taxpayer should avoid. By the end, you’ll know how to save money, reduce stress, and file your returns confidently – ITR Mistakes That Can Drain Your Hard-Earned Money – Income Tax Mistakes.

Why Avoiding ITR Mistakes is Crucial

- Mistakes can lead to penalties up to ₹5,000–₹10,000 under Section 234F.

- Incorrect filing often results in refund delays of several months.

- Non-compliance increases the chances of income tax scrutiny and notices.

- Accurate filing builds your financial credibility for loans, visas, and investments.

In short, avoiding ITR Mistakes That Can Drain Your Hard-Earned Money is about financial safety and peace of mind – Income Tax Mistakes.

7 ITR Mistakes That Can Drain Your Hard-Earned Money

1. Choosing the Wrong ITR Form

Many taxpayers select the wrong ITR form, thinking “all forms are the same.” For example:

| Wrong Form Chosen | Correct Form | Impact |

|---|---|---|

| Salaried individual filing ITR-3 | Should use ITR-1 | Rejection of return |

| Business income reported in ITR-1 | Should use ITR-3 | Penalties, re-filing required |

Filing with the correct form ensures acceptance and avoids notices – ITR Mistakes That Can Drain Your Hard-Earned Money – Income Tax Mistakes.

2. Missing the ITR Filing Deadline

The last date to file ITR is usually 31st July for individuals. Missing the deadline can lead to:

- Late fees of up to ₹5,000 under Section 234F.

- Loss of opportunity to carry forward losses.

- Delay in refund claims.

To avoid this ITR Mistake That Can Drain Your Hard-Earned Money, always file before the deadline – ITR Mistakes That Can Drain Your Hard-Earned Money.

3. Not Reporting All Sources of Income

A very common mistake is not reporting:

- Interest from savings accounts & FDs

- Freelance or side hustle income

- Rental income

- Capital gains from shares/crypto

The Income Tax Department already tracks most of these through Form 26AS and AIS (Annual Information Statement). If you hide or forget income, you may face penalties and notices – ITR Mistakes That Can Drain Your Hard-Earned Money.

4. Errors in Bank & Personal Details

Providing incorrect bank account numbers or mismatched PAN/Aadhaar details can block your refund process – ITR Mistakes That Can Drain Your Hard-Earned Money.

Always double-check:

- PAN & Aadhaar linkage

- Bank IFSC code & account number

- Email & mobile number for OTPs

5. Incorrect Claim of Deductions & Exemptions

Many taxpayers either:

- Claim deductions without proof (e.g., fake rent receipts for HRA)

- Forget valid deductions (e.g., Section 80C, 80D, NPS, ELSS)

This is one of the most serious ITR Mistakes That Can Drain Your Hard-Earned Money because false claims = penalties, while missed claims = lost savings.

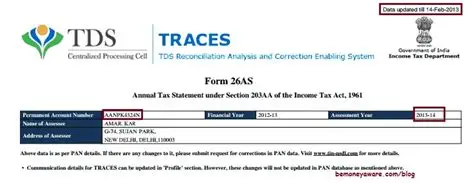

6. Ignoring Form 26AS & AIS Reconciliation

Before filing, taxpayers should cross-check income data with Form 26AS and AIS. If reported income mismatches with actual records, your return may be flagged – Income Tax Mistakes.

Example: If TDS deducted by employer = ₹20,000 but you enter ₹15,000, the system auto-detects the mismatch – ITR Mistakes That Can Drain Your Hard-Earned Money.

7. Failing to Verify Your ITR After Filing

Even after filing, your ITR is incomplete until you verify it. You can verify via:

- Aadhaar OTP

- Net banking

- Bank account validation

- Sending signed physical copy to CPC, Bengaluru

Unverified ITRs are considered invalid. This final step ensures your filing is complete – Income Tax Mistakes.

Quick Checklist to Avoid ITR Mistakes

* Use the correct ITR form

* File before the deadline (31st July)

* Report all income sources

* Cross-check Form 26AS & AIS

* Enter correct bank & PAN/Aadhaar details

* Claim only valid deductions

* Verify your ITR after filing

Additional Tips to Save Your Hard-Earned Money

- Keep a folder of investment proofs ready before filing.

- Use authorized portals like Income Tax India e-filing.

- Refer to reliable guides like Investopedia Tax Guide.

- Track latest updates via Times of India – Personal Finance.

- Consider professional support from Unlock Digi Services – Income Tax Mistakes.

Why Businesses Must Be Extra Careful

For companies, ITR Mistakes That Can Drain Your Hard-Earned Money include:

- Wrong GST & TDS reconciliation

- Failure to declare international transactions

- Missing audit requirements under Section 44AB

These errors not only cause penalties but also impact investor trust and compliance ratings – Income Tax Mistakes.

Conclusion

Filing ITR isn’t just about submitting numbers — it’s about ensuring your hard-earned money stays with you. By avoiding these 7 ITR Mistakes That Can Drain Your Hard-Earned Money, you can:

- Save penalties

- Get refunds faster

- Stay stress-free and compliant

Call to Action (CTA)

Filing your ITR correctly is not just about compliance – it’s about protecting your hard-earned money and securing your financial future. Don’t let costly mistakes drain your savings – Income Tax Mistakes.

At UnlockDigiServices, our experts make your ITR filing stress-free, accurate, and 100% compliant with the latest tax laws. Whether you are a salaried individual, business owner, or professional, we help you file the right return, maximize deductions, and avoid penalties.

Call Us Now: +91 94819 60948

Email: info@unlockdiscounts.com

Don’t wait until the deadline – book your consultation today and let us handle your ITR filing with confidence!

Nice tips