Income Tax Return (ITR) filing is a critical obligation for both individuals and businesses in India. While the process is now more streamlined thanks to digital platforms and simplified forms, many taxpayers still make avoidable mistakes that can lead to penalties, tax notices, or even audits, ITR Filing Mistakes.

At UnlockDigiServices, we help clients stay compliant and stress-free during tax season. In this blog post, we’ll walk you through the most common ITR filing mistakes and how to avoid them, ensuring a smooth filing experience for individuals and businesses alike.

Why Avoiding ITR Filing Mistakes Matters

Even small errors in your ITR can lead to serious consequences such as:

- Penalty charges under Section 234F of the Income Tax Act

- Delayed refunds or missed refund opportunities

- Legal scrutiny and income tax notices

- Higher chances of audits

- Poor financial record for loan or visa applications

Let’s explore the common pitfalls you should watch out for, ITR Filing Mistakes

Missing the Due Date

One of the biggest mistakes is missing the ITR filing deadline. For individuals and non-audit businesses, the due date is usually July 31st, while audited accounts have until October 31st.

Tip: Set calendar reminders or engage a tax consultant to stay ahead of the deadline.

Filing Under the Wrong ITR Form

Choosing the incorrect ITR form is another common error. Each form is designated for a specific taxpayer category.

- ITR-1: Salaried individuals (income < ₹50 lakh)

- ITR-2: Individuals with capital gains or foreign assets

- ITR-3: Professionals and business owners

- ITR-4: Presumptive income under Section 44AD/ADA

Filing the wrong form may render your return invalid, ITR Filing Mistakes

Not Reporting All Sources of Income

Many individuals forget to include:

- * Interest from savings or fixed deposits

- * Freelance or side gig income

- * Rental income

- * Foreign income or assets (NRI returns)

Non-disclosure can attract scrutiny and fines. Always ensure full income disclosure, even if the amount seems small.

Ignoring Form 26AS and AIS

Your Form 26AS and Annual Information Statement (AIS) provide a consolidated view of your TDS, tax payments, and high-value transactions. Not matching your ITR details with these can lead to discrepancies and notices.

Always cross-check your reported income and TDS with these forms before submission.

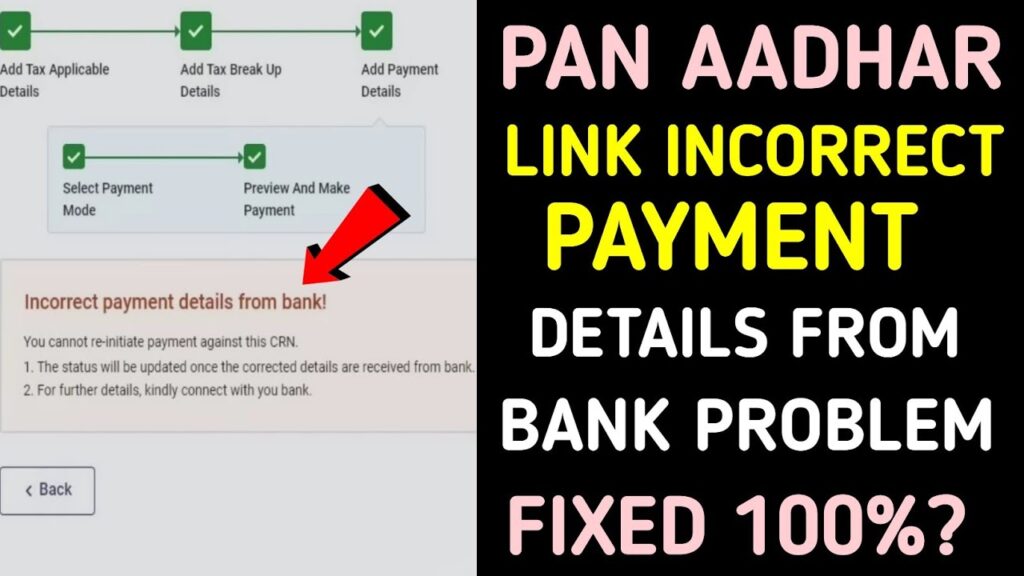

Incorrect Bank Details

Mistyped bank account numbers or IFSC codes can delay your income tax refund. Make sure your bank account is active and linked to your PAN to receive timely refunds.

Not Verifying the ITR

Filing your ITR isn’t complete until you e-verify it. If not verified within 30 days of filing, your return will be treated as invalid, ITR Filing Mistakes.

Use methods like:

- * Aadhaar OTP

- * Net banking

- * EVC (Electronic Verification Code)

Overlooking Deductions and Exemptions

Many taxpayers forget to claim eligible deductions under:

- * Section 80C (Investments, LIC, PF, etc.)

- * Section 80D (Health insurance premiums)

- * Section 24(b) (Home loan interest)

Missing out means you pay more tax than necessary. Maintain proper documentation and consult a tax expert to maximize benefits.

Mismatch Between Income and Expenses for Businesses

For business owners, mismatches in declared income and expenses can trigger red flags. Ensure:

- * Proper bookkeeping

- * Accurate GST returns (if applicable)

- * Consistency across TDS, ITR, and financial statements

Not Maintaining Proper Records

Income tax officers can ask for documentation even years later. Keep:

- * Salary slips

- * Investment proofs

- * Bank statements

- * Expense receipts

Digital storage is a good way to organize these securely.

Relying Solely on Software Without Professional Review

While DIY tax tools are helpful, they may not catch all compliance issues. Engaging a trusted tax consultant like Unlock Digi Services ensures accuracy, optimization, and peace of mind.

Final Thoughts

Avoiding these common ITR filing mistakes is crucial to stay compliant, avoid penalties, and optimize your tax liability. Whether you’re a salaried individual, freelancer, or business owner, attention to detail and professional guidance can make all the difference, ITR Filing Mistakes

“Even a minor oversight in your ITR can result in delays, penalties, or future complications with financial documentation. Stay ahead by staying informed.”

Let Unlock Digi Services Handle Your ITR the Right Way

Don’t let simple errors cost you big! At Unlock Digi Services, we offer end-to-end ITR filing solutions for individuals and businesses. Our experts ensure accurate filings, timely submissions, and maximum tax benefits.

Contact us today or visit Unlockdigiservices to book a consultation.

Stay compliant. File smart. Unlock peace of mind.