Introduction

Filing your Income Tax Return (ITR) on time is not just a formality—it’s a financial necessity. Whether you’re a salaried individual, freelancer, or business owner, failing to meet the deadline can lead to serious penalties and long-term financial consequences.

In this blog, Unlock Digi Services explains the 4 serious penalties for missing ITR deadlines, how they can impact your finances, and what you should do to avoid them. Understanding these consequences will help you stay compliant and avoid unnecessary losses.

What Is the ITR Deadline?

The Income Tax Return (ITR) deadline is the last date for submitting your annual tax returns to the Income Tax Department. For most individual taxpayers, the deadline is 31st July of the assessment year (unless extended by the government).

Missing this deadline can attract multiple types of penalties under various sections of the Income Tax Act.

Official ITR Filing Portal

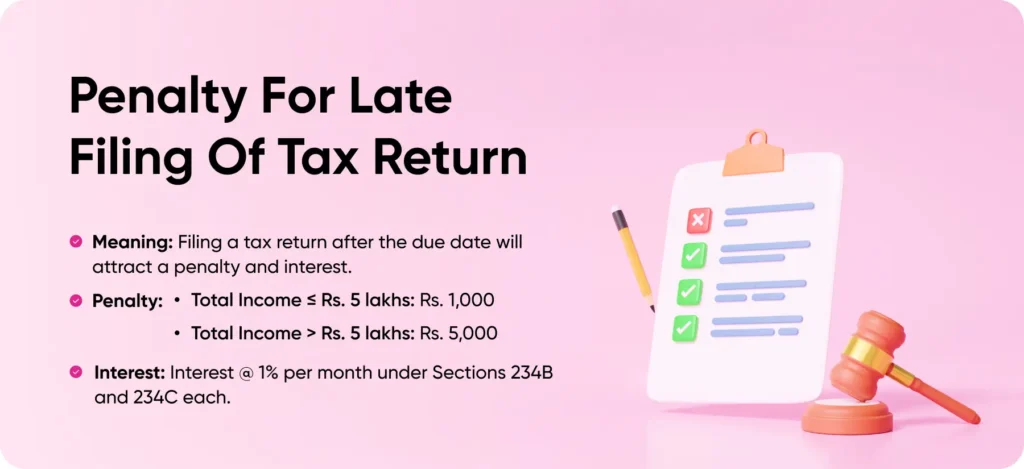

1. Late Filing Fee Under Section 234F

The most immediate penalty for missing the ITR deadline is a mandatory late filing fee under Section 234F.

Fee Structure:

- Filed after due date but before 31st December: ₹5,000

- Filed after 31st December: ₹10,000

- Income below ₹5 lakh: Maximum penalty is ₹1,000

Even if you don’t have any tax liability, you are still liable to pay this penalty if the return is filed late.

Section 234F – ClearTax Explanation

2. Interest on Tax Due Under Section 234A

If you have outstanding tax dues, a late ITR filing attracts interest under Section 234A.

How It Works:

An interest of 1% per month (or part of the month) is charged on the unpaid tax amount from the due date of filing till the actual date of filing.

Example:

If your unpaid tax amount is ₹20,000 and you file 3 months late, you’ll pay ₹600 extra as interest (₹20,000 x 1% x 3).

This is in addition to the late filing fees under Section 234F.

3. Loss of Carry Forward Benefits

This is one of the most overlooked yet impactful penalties. If you incur losses under the head Capital Gains or from Business & Profession, you can carry them forward to offset future profits—but only if you file on time.

Losses You Cannot Carry Forward If You File Late:

- Short-term and long-term capital losses

- Business losses (excluding depreciation)

- Speculative business losses

- Losses from racehorses

By missing the ITR deadline, you lose the ability to carry forward these losses, resulting in higher tax liabilities in the future.

4. Delayed or Denied Refunds

If you’re eligible for a refund due to excess TDS or advance tax, a delayed ITR can postpone or even forfeit your refund benefits.

Why This Happens:

- Returns filed after the due date are processed later.

- Refunds are not prioritized for late filers.

- You may not get interest on the refund if you delay the filing.

Other Consequences of Missing the Deadline

Apart from the major penalties listed above, other potential issues include:

- Reduced loan/creditworthiness: Banks often require timely filed ITRs for loan applications.

- Visa denials: Immigration authorities in some countries ask for 3 years’ ITR.

- Prosecution in severe cases: Continuous non-compliance may lead to legal proceedings with imprisonment of up to 7 years.

Why Timely Filing Is Crucial for Businesses

Businesses that delay filing face:

- Audit notices and increased scrutiny

- Ineligibility for government tenders

- Loss of investor trust and difficulty in raising funds

Compliance isn’t just about avoiding fines—it’s about business credibility.

How Unlock Digi Services Can Help

At Unlock Digi Services, we specialize in fast, accurate, and affordable ITR filing services for individuals, freelancers, and businesses.

Our services include:

- Expert review of your tax documents

- Income-tax planning and advisory

- Filing under proper tax heads (ITR-1 to ITR-7)

- Carry-forward loss planning

- Faster refund processing

Call us: +91 94819 60948

WhatsApp: +91 94819 60948

Email: info@unlockdiscounts.com