Filing Income Tax Returns (ITR) in India can feel overwhelming, especially during the busy tax season. Between organizing documents, choosing the right ITR form, ensuring compliance, and meeting deadlines, many individuals and businesses spend unnecessary hours—or even days—navigating this process.

Thankfully, with the rise of Smart ITR Filing Tools, you no longer need to get lost in a maze of paperwork or complex portals. These Smart ITR Filing Tools are designed to simplify the entire filing journey—from data import to auto-calculation—making them a must-have for anyone seeking speed and accuracy. Whether you’re a salaried employee, freelancer, or business owner, Smart ITR Filing Tools can help you save time, reduce stress, and avoid costly errors.

Let’s dive into the top digital platforms and smart strategies you can use to streamline your ITR filing today.

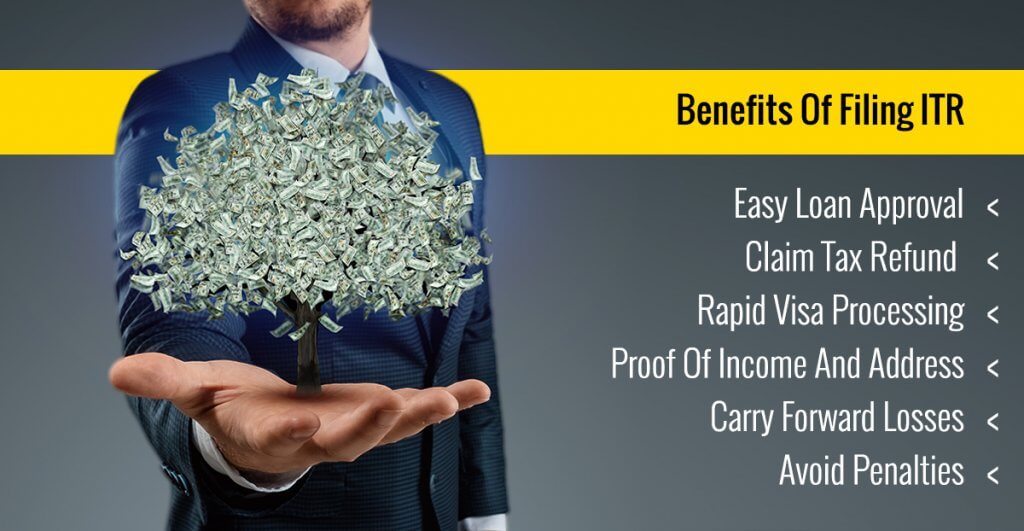

Why You Should Consider Smart ITR Filing Tools

Before jumping into specific tools, it’s important to understand why they matter:

Time Efficiency

Manual tax filing can take hours or days. Smart tools automate calculations, fetch data directly from official sources (like Form 26AS or AIS), and generate accurate reports.

Error Reduction

Mistakes in ITR filing can lead to notices, penalties, or delayed refunds. Filing tools cross-check entries, highlight discrepancies, and alert you before submission.

Expert Guidance

Many platforms offer AI-based suggestions or human expert review. You get the best of both worlds—technology + tax knowledge.

Record-Keeping & Documentation

No more hunting through emails or file cabinets. These platforms store your past returns, tax documents, and acknowledgments in one secure place.

Best Smart ITR Filing Tools to Save Time and Avoid Errors

Here are some of the most reliable and Smart ITR Filing Tools that can help you save time and stay compliant:

ClearTax

ClearTax is one of India’s most trusted e-filing platforms. It’s perfect for salaried individuals, freelancers, and even small businesses.

Features:

- * Auto-import of Form 16

- * Integration with Form 26AS

- * AI-powered tax-saving tips

- * Expert-assisted filing available

Time-Saving Factor: ⏱ Cuts filing time by up to 70%

Income Tax Portal (Incometax.gov.in)

The government’s official e-filing platform now comes with a much-improved interface.

Features:

- * You can also cross-verify filing deadlines directly on the Income Tax Department’s official site.

- * Prefilled ITRs for salaried individuals

- * Link to AIS and TIS data

- * Direct bank account verification

- * Instant e-verification via Aadhaar/OTP

Time-Saving Tip: Use the “Prefilled Return” option to skip redundant data entry.

Quicko

Quicko is a modern platform designed especially for traders, investors, and professionals with multiple income sources.

Features:

- * Import data from Zerodha, Groww, Upstox, etc.

- * Calculate capital gains automatically

- * Detailed breakdown of deductions

- * Tax planning dashboard

Best for: Stock market participants and crypto investors

Winman CA-ERP (for Professionals)

Ideal for tax professionals and CA firms, Winman’s software simplifies bulk ITR processing for multiple clients.

Features:

- * Bulk PAN validation

- * Integrated TDS, GST, and ITR modules

- * Data import/export via Excel

- * MIS reporting and audit support

Unlock Digi Services (Yes, that’s us!)

At Unlock Digi Services, we combine professional tax expertise with smart automation tools to deliver a seamless ITR filing experience.

Our strengths:

- * Personalized consultation

- * Document pickup and digital processing

- * Error-free ITR preparation

- * Guaranteed on-time submission

- * Real human support (not just bots!)

Want expert help without the stress? Contact us now.

Types of Users Who Benefit from Smart ITR Filing Tools

Salaried Individuals

Smart tools fetch your Form 16, calculate HRA, and help you claim 80C, 80D, and other deductions instantly.

Freelancers & Consultants

Automated expense tracking, invoicing, and income aggregation save hours of manual work.

Small Business Owners

From GST to TDS to ITR—everything can be integrated and managed in one dashboard.

Traders & Investors

Capital gains, F&O losses, or dividend income—smart tools sort it out in seconds.

Tips to Maximize the Benefits of Smart ITR Filing Tools

Keep Documents Ready

Have your PAN, Aadhaar, bank details, income statements, and investment proofs organized before logging in.

Choose the Right ITR Form

Many tools help auto-select your ITR form based on your profile. Double-check it to avoid rejections.

Use E-Verification

E-verifying your ITR using Aadhaar OTP, net banking, or DSC saves time compared to physical submission.

Don’t Wait Till the Last Date

Peak traffic on portals can cause downtime. File early to enjoy peace of mind.

Consult Experts When Needed

AI helps, but a tax expert can catch things automation might miss—especially if you have multiple income sources or complex deductions.

Is Your Data Safe with Smart Filing Tools?

Yes—if you’re using verified, encrypted, and authorized platforms like those mentioned above. Look for:

- * SSL Encryption

- * ISO/IEC 27001 certification

- * Government-authorized e-return intermediary (ERI) status

Bonus Tip: Never share your OTPs or login credentials on suspicious sites.

Why Unlock Digi Services Is Your Smartest ITR Move

At Unlock Digi Services, we simplify tax filing with:

- * Real humans, not just automated chatbots

- * Transparent pricing—no hidden costs

- * End-to-end handling (documents, filing, follow-up)

- * Expert advice tailored to your profile

- * Easy-to-use tools backed by professional support

Whether you’re a salaried individual or managing a growing business, we’re here to make ITR filing stress-free, fast, and fully compliant.

Save Time. Avoid Errors. File Smart.

Ready to file with confidence? Let Unlock Digi Services help you with Smart ITR Filing Tools built for accuracy and speed.

Don’t let tax season slow you down. Let UnlockDigiServices help you file your ITR the fast, accurate, and secure way—powered by Smart ITR Filing Tools.

Contact us now or visit UnlockDigiServices.com to schedule your FREE tax consultation.

Start saving time today. Unlock your peace of mind.

Excellent content 💯👏