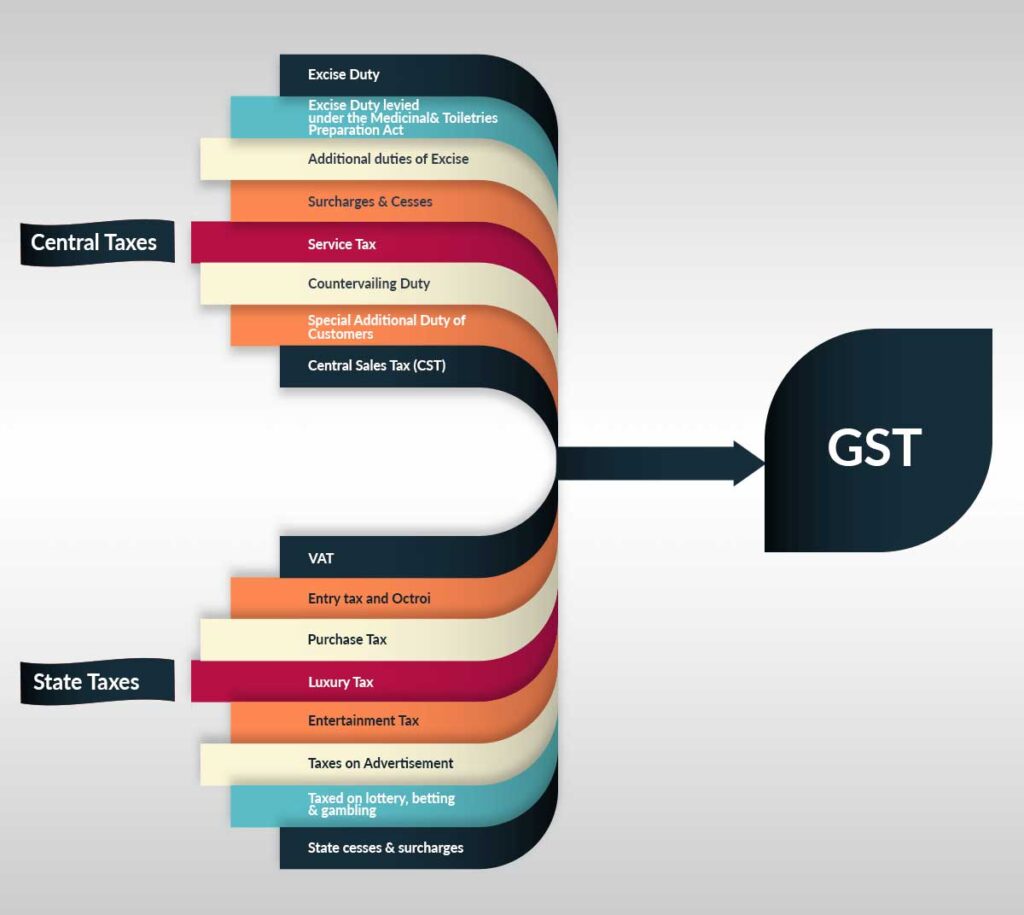

When the Goods and Services Tax (GST) was introduced in India on July 1, 2017, it was considered one of the most significant tax reforms in the country’s history. For decades, businesses had struggled with a complex web of indirect taxes like VAT, Service Tax, Excise Duty, Octroi, and Entry Tax. Each state followed different rules, and small businesses had to spend a lot of time and money to stay compliant.

Initially, many small business owners were anxious about GST, fearing that the digital filing system and multiple tax slabs would increase their burden. However, over the years, the Positive Side of GST has become increasingly evident. It has simplified compliance, reduced cascading taxes, and opened new growth opportunities for small and medium-sized enterprises (SMEs).

In this article, we will explore the Positive Side of GST in detail, highlighting how it empowers entrepreneurs, boosts transparency, and simplifies the journey of small business growth in India.

Understanding GST in India

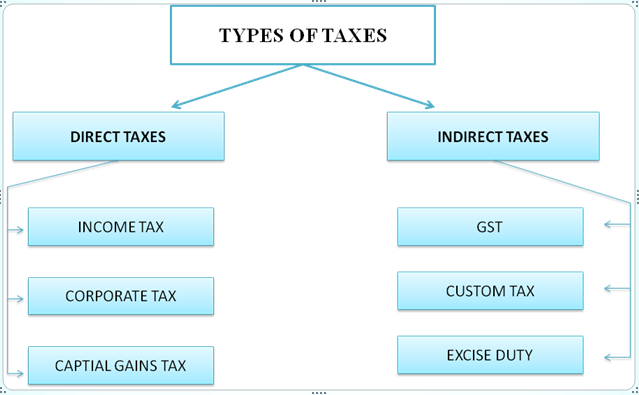

GST is a destination-based indirect tax that replaced multiple indirect taxes at the central and state levels. Instead of paying different taxes at every stage of production and distribution, businesses now pay one unified tax — GST.

Some quick facts:

- Implemented in 2017 as “One Nation, One Tax.”

- Applies to goods and services across India.

- Digital filing system ensures compliance online.

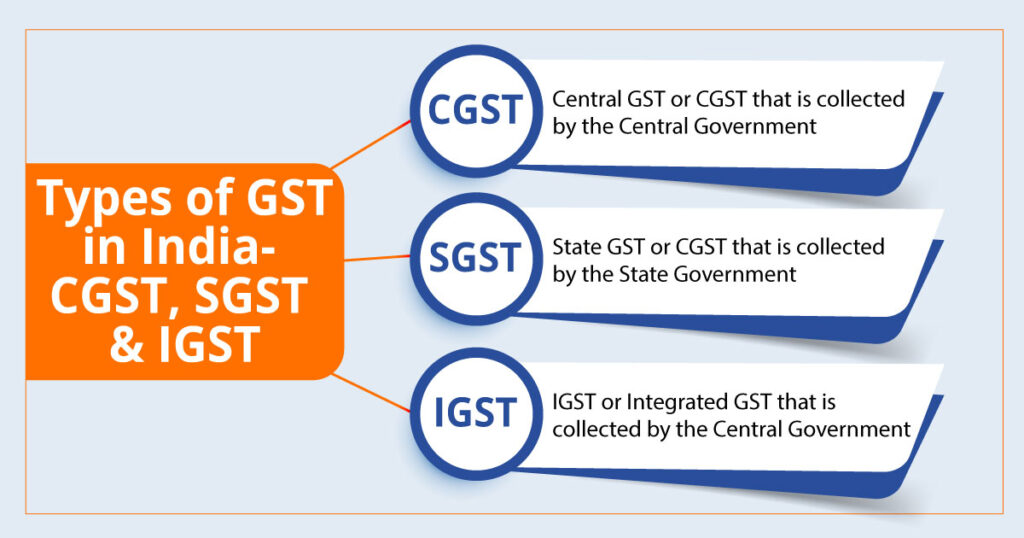

- Taxes are divided into CGST (Central GST), SGST (State GST), and IGST (Integrated GST).

This single tax reform has streamlined taxation, reduced paperwork, and created a level playing field for businesses of all sizes. For small businesses, the Positive Side of GST lies in the way it simplifies processes and fosters growth opportunities.

The Positive Side of GST for Small Businesses

1. Simplified Tax Structure

Before GST, small businesses had to deal with a confusing tax maze. For example, a manufacturer had to pay excise duty, VAT, and service tax depending on the product or service. Now, under GST, all these have been merged into one tax system.

Example:

- A small furniture shop earlier had to file VAT and Service Tax separately.

- Under GST, the same shop now files a single return, saving time and money.

Table: Tax System Before GST vs After GST

| Aspect | Pre-GST (VAT, Excise, Service Tax) | GST System (Post-2017) |

|---|---|---|

| Number of Taxes | Multiple | Single Unified Tax |

| Filing Method | Offline / Paperwork-heavy | Digital, Online Filing |

| Interstate Trade | Tax Barriers, Forms Required | Seamless Movement |

| Compliance Cost | High | Reduced Significantly |

This Positive Side of GST ensures that even the smallest shopkeeper or entrepreneur can manage tax compliance more easily.

2. Ease of Compliance through Digital Filing

The Positive Side of GST also lies in its digital-first approach. Small businesses no longer need to visit multiple government offices to file returns. Instead, everything is done online through the GST portal.

- GST returns, invoices, and e-way bills can be generated and filed digitally.

- Reduced corruption and middlemen costs.

- Business owners can track their tax credits and payments easily.

Example: A small garment trader in Gorakhpur can now file GST returns directly from a computer or even a mobile app, without depending on an accountant every month.

This move has empowered small businesses to focus more on growth and less on paperwork.

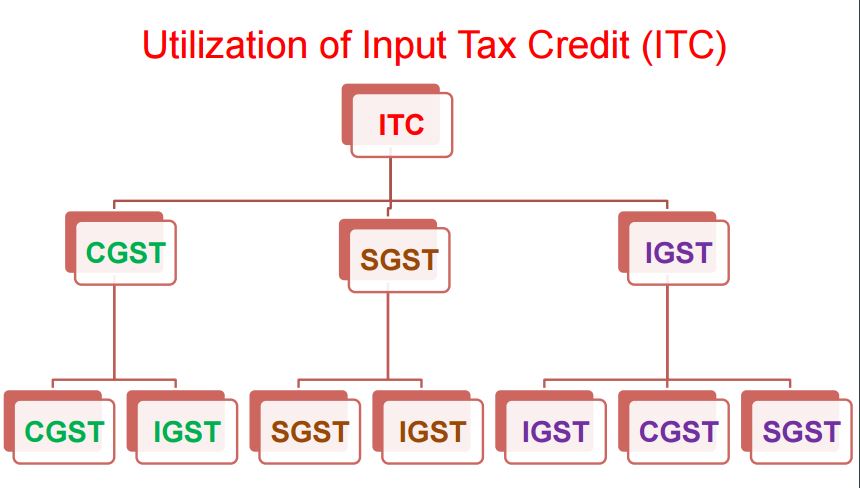

3. Input Tax Credit (ITC) Benefit

One of the strongest Positive Sides of GST is the Input Tax Credit (ITC) system. Earlier, businesses had to pay tax on the total value of sales, even if they had already paid tax on raw materials. This led to tax-on-tax, also called the cascading effect of taxes.

Now, under GST, small businesses can claim credit for the tax already paid on inputs.

Example Calculation:

- A manufacturer buys raw materials worth ₹1,00,000 and pays 18% GST (₹18,000).

- He sells the final product for ₹2,00,000 with 18% GST (₹36,000).

- Under GST, he only pays ₹18,000 net tax after adjusting ITC.

This Positive Side of GST directly reduces costs, improves margins, and makes small businesses more competitive.

4. Expansion of Market Reach

Before GST, selling goods across states was complicated due to different tax laws. Businesses had to deal with entry taxes, CST (Central Sales Tax), and multiple forms at checkpoints.

With GST, interstate trade has become seamless. This means that a small business in Gorakhpur can sell to Delhi, Mumbai, or Bangalore without extra tax hurdles.

Example:

- SMEs selling online through Amazon, Flipkart, or Shopify can now deliver products across India with a single GST registration.

- This has helped small businesses expand their customer base nationally.

This Positive Side of GST has unlocked new market opportunities for entrepreneurs.

5. Transparency and Reduced Tax Evasion

The GST system is based on transparent invoicing. Every invoice must include the supplier’s GSTIN (GST Identification Number). This creates a proper digital trail, reducing the chances of tax evasion.

For small businesses, this means:

- More trust from customers.

- A fair playing field where larger companies cannot avoid taxes.

- Greater credibility while applying for loans and government tenders.

This Positive Side of GST helps in building a more honest business ecosystem.

6. Competitive Edge for SMEs

Earlier, many small businesses could not compete with larger players because of the cascading tax burden and hidden costs. Now, thanks to the Positive Side of GST, SMEs can compete on fairer terms.

- Uniform tax rates across states make pricing competitive.

- ITC reduces costs and improves profit margins.

- Customers prefer buying from GST-compliant businesses.

Example:

A local shoe manufacturer in Kanpur can now sell at nearly the same price as a big brand, thanks to input tax credit and fair pricing.

7. Boost to Startups and the Digital Economy

India’s startup ecosystem has grown significantly since GST. By reducing tax complexities and supporting e-commerce, GST has given startups the confidence to scale faster.

Positive Side of GST for Startups:

- Easy GST registration online.

- Faster nationwide expansion without multiple state registrations.

- Access to ITC benefits, reducing operational costs.

- Boost to fintech, SaaS, and e-commerce startups.

This makes the Positive Side of GST highly relevant for the digital-first generation of entrepreneurs.

GST vs Old Tax System: A Quick Comparison

| Aspect | Pre-GST System (VAT/Excise/Service) | GST System |

|---|---|---|

| Taxes Applied | Multiple (VAT, Service Tax, Excise) | One GST |

| Compliance | Offline, manual | Online, digital |

| Interstate Trade | Multiple forms & taxes | Seamless trade |

| Input Tax Credit | Limited | Full ITC available |

| Transparency | Low | High Transparency |

| Ease of Doing Business | Difficult | Simplified |

This comparison shows how the Positive Side of GST is clearly more favorable for small businesses.

Challenges in GST Implementation (Brief)

Of course, no system is perfect. GST has faced criticism for:

- Multiple tax slabs (5%, 12%, 18%, 28%).

- Initial technical glitches in the portal.

- Compliance costs for very small traders.

However, despite these issues, the Positive Side of GST continues to outweigh the negatives. Over time, improvements and simplifications have been introduced, making GST more small-business-friendly.

FAQs about GST and Small Business Growth

Q1. What is the Positive Side of GST for small businesses?

The Positive Side of GST includes simplified taxation, digital filing, ITC benefits, nationwide market access, and reduced compliance costs.

Q2. How does GST simplify compliance?

It replaces multiple taxes with a single digital system, making filing and tracking easier.

Q3. Can startups benefit from GST?

Yes, startups benefit through ITC, nationwide operations, and simplified registration.

Q4. Is GST mandatory for all SMEs?

Businesses with annual turnover above ₹40 lakhs (₹20 lakhs in some states) must register under GST.

Q5. How does GST improve transparency?

Through GSTIN-linked invoices and digital filing, reducing tax evasion and ensuring fair competition.

Conclusion

The Positive Side of GST is undeniable. While it began as a complex reform, GST has transformed into a powerful tool that empowers small businesses in India. By simplifying taxation, promoting transparency, reducing costs, and expanding market reach, GST has truly become a growth enabler for SMEs and startups.

Small businesses are the backbone of the Indian economy, and GST has given them a chance to compete on equal footing with larger corporations.

If you are a small business owner, embracing the Positive Side of GST will not only keep you compliant but also open doors to new opportunities.

Call-to-Action

Are you ready to take your small business to the next level with GST and digital growth strategies?

Connect with UnlockDigiServices today for expert guidance on compliance, digital marketing, and performance strategies.

Call Us Today: +91 94819 60948

Email: info@unlockdiscounts.com

One Response